Deferred Revenue

Deferred Revenue is revenue that is held, and not recognized until a stated time, after which it becomes actual revenue. Deferred revenue can be set up for subscriptions, memberships, events, and other prepaid products.

Important! netFORUM has different rules for deferral of Membership Products and Non-Membership Products. Membership Deferral is restricted to the Term of the Membership, while Non-Membership Deferral is restricted to a "One-Time" Recognition. Baseline netFORUM does NOT allow for a "One-Time" deferral of Membership Dues.

How Deferrals Work

The deferral process is run monthly at the close of the Accounting Period. Each month, revenue will be recognized for the appropriate transactions based on the start and end date of a term-based product, or the recognition date of other products. No revenue will be recognized prior to the start of the term of a term-based product. The last period will pick up any extra cents from rounding.

Definition of Terms

The following terms are used throughout the document:

- Invoice Amount

- The price of the product as it appears on the Invoice.

- Recognize After Date

- Used for products that are not term based and defines the date revenue should be recognized.

- Product Term

- The start and end date of the customer's term for the product.

- Batch Period

- The fiscal period in which the product was sold. This refers to the period that the deferral record is written.

- Fiscal Year

- The accounting year.

- Deferral Start Date

- The begin date for the term of the product.

- Deferral Start Period

- The fiscal period corresponding to the Deferral Start Date.

- Deferral End Date

- The completion date for the term of the product.

- Deferral End Period

- The fiscal period corresponding to the Deferral End Date.

- Deferral Amount

- The amount of revenue being deferred.

- Frequency

- The number of months between recognitions.

- Number of Periods

- The number of fiscal periods between the Deferral Start Period and the Deferral End Period inclusive.

- Recognition Amount

- The amount of revenue to be recognized each time revenue is recognized. This is the

- # Recognized

- This is the number of periods that have been recognized.

- # Recognitions Left

- This is the remaining number of times that revenue will be recognized. The total number of recognitions is:

(Number of Period - Number of Periods Recognized)

- Last $ Recognized

- The amount of revenue that was recognized the last time revenue was recognized.

- Last Period Recognized

- The last period in which revenue was recognized.

- Next Period Recognized

- The next period in which revenue will be recognized.

- Total Recognized

- The total amount of revenue that has been recognized for this sale.

- Balance

- The remaining deferred revenue balance. This is equal to:

(Deferral Amount — Total Recognized)

- Close Flag

- This identifies whether there are periods remaining to be recognized. (Technical: A value of "0" means that the deferral is open and there is more revenue to be recognized. A value of "1" means that the deferral is closed and no more revenue will be recognized)

Adding Records

Setting Up Deferred Revenue

Warning: Once a deferred product is sold, the Deferred G/L and Revenue G/L accounts should Never be altered. The revenue recognition process relies on the G/L accounts defined on the price record for the life of the deferral. Changing the G/L accounts after the deferral process has started will result in incomplete reduction of the original sale credit in the deferred G/L account and incorrect recognition (credit) in the revenue G/L account.

Once a deferred product has been sold, if the price G/L accounts need to be altered, the correct procedure is to end date the incorrect price record, and to create a new price record with the adjusted G/L accounts. Corrective adjustments may be desired to reflect the G/L account changes for incorrectly posted deferred products already in progress. Changing the Revenue or Deferred G/L accounts on deferred products in progress is not supported.

Non-Membership Deferral

To set up Deferred Revenue, when you add a non-membership product: subscription, event, etc. select the deferred check box and designate a deferred account for the revenue to go into once the revenue is recognized.

For non-membership products, events, and other one-time deferrals, you will also need to set up a recognize after date. The recognize after date determines the accounting period in which the revenue will be available for recognition. When the appropriate accounting period is processed, the deferred revenue (with recognize after dates that fall within that accounting period) will be available for recognition.

Membership Deferral

For memberships, the update dates when (% paid, batch closed, etc.) determine when a membership is officially active. The Deferred revenue schedule is set based on the dates of the membership. The update dates when values can be changed by editing the Association Profile Page or the Add Member Type page. When an accounting period is closed, the deferred revenue (with update dates values that fall within that accounting period) will be available for recognition.

Note: When the batch closes, income is deferred; When the period closes, income is recognized.

Managing Records

Deferral Scenarios

These scenarios are intended as a guide for understanding deferred revenue functionality and to serve as a basis for a testing plan. These use cases are outlined to show the values that will be in the deferral table after the monthly revenue recognition process has been run from the Accounting Period.

Scenarios

- Deferral Use Case (General Product)

- Deferral Use Case (Date Based Anniversary)

- Deferral Use Case (Calendar Based)

One-time Deferrals

For non-term based products such as event registrations, exhibits, and merchandise, you can use one-time revenue deferral by specifying a date in the recognize revenue after date option.

The date in the recognize revenue date option in Events or the recognize after option in Merchandise determines when netFORUM recognizes the revenue from the sale. If the registration or product is sold before the specified recognition date, the revenue is not recognized, the money goes into deferred revenue. Any money in deferred revenue is recognized when the recognition process is run for the period that ends after the recognition date for the event or product. If the registration or product is sold after the recognition date, closing the batch sends the money directly to revenue for the period ending after the recognition date.

Note: When you close a batch, netFORUM creates ledger entries. When you close a period, netFORUM recognizes deferred revenue for the recognition dates contained in that period.

Term-based Deferrals

A term-based product is a product that terminates or expires after a set period of time. A 12-month subscription is an example of a term-based product. Revenue is recognized in increments starting with the term start date and ending with the term end date, based on the selected recognition frequency: monthly, quarterly, semi-annually, or annually.

If the term dates for a deferred product are changed, as could be the case with a prorated membership, the term length will be either reduced or extended, as appropriate. The amount recognized each month will change to the amount that would be recognized based on the new term. If the term is extended, less will be recognized in the next month(s)as too much revenue has now been recognized. If the term is reduced, additional revenue will be recognized in the next period to catch the deferral up based on the new recognition term.

For example, if a term-based product is sold for $120 with a one year term and monthly recognition, $10 would be recognized per period ($120/12). If four months have been recognized ($40), and the term is shortened to 10 months, the next period will recognize $20 ($12 for the monthly recognition based on 10 period and $8 to catch up the revenue). If the term is lengthened to 20 months, no revenue will be recognized until the amount that should be recognized exceeds the $40 that has already been recognized. Since this would typically recognize $6 per month, no revenue will be recognized until the 7th period. In that period, $2 will be recognized.

Note: When the batch closes, revenue is deferred; When the period closes, revenue is recognized.

Deferring Revenue for Subscriptions

A subscription can be set up either as a term-based product, which means it terminates or expires after a set period of time (e.g., 12-month period), or based on a specific number of issues to be fulfilled.

When you sell a term-based subscription, you will be defining the term of the subscription. This will also be the term for the revenue recognition. When you Add a Subscription, you must select the recognition frequency: monthly, quarterly, semi-annually, or annually. Revenue is recognized in increments, starting with the term start date and ending with the term end date, based on the selected recognition frequency.

If the term dates for a deferred product are changed, the term length will be either reduced or extended, as appropriate. The amount recognized each month will change to the amount that would be recognized based on the new term. If the term is extended, less will be recognized in the next month(s)as too much revenue has now been recognized. If the term is reduced, additional revenue will be recognized in the next period to catch the deferral up based on the new recognition term.

For example, if a term-based product is sold for $120 with a one year term and monthly recognition, $10 would be recognized per period ($120/12). If four months have been recognized ($40), and the term is shortened to 10 months, the next period will recognize $20 ($12 for the monthly recognition based on 10 period and $8 to catch up the revenue). If the term is lengthened to 20 months, no revenue will be recognized until the amount that should be recognized exceeds the $40 that has already been recognized. Since this would typically recognize $6 per month, no revenue will be recognized until the 7th period. In that period, $2 will be recognized.

When you sell an issue-based subscription, the recognition will be done as part of the subscription fulfillment process. In this case the recognition amount will be based on the number of issues being fulfilled divided by the number of issues purchased.

Note: When the batch closes, income is deferred; When the period closes, income is recognized.

Deferring Revenue for an Event

To set up deferred revenue for an event, on the Add Event page, select the deferred check box and designate a deferred account for the revenue to go into once the revenue is recognized. You can also set up a recognize-after date.

The date in the recognize revenue date option in Events or the recognize after option in Merchandise determines when netFORUM recognizes the revenue from the sale. If the registration or product is sold before the specified recognition date, the revenue is not recognized, the money goes into deferred revenue. Any money in deferred revenue is recognized when the recognition process is run for the period that ends after the recognition date for the event or product. If the registration or product is sold after the recognition date, closing the batch sends the money directly to revenue for the period ending after the recognition date.

Note: When you close a batch, netFORUM creates ledger entries. When you close a period, netFORUM recognizes deferred revenue for the recognition dates contained in that period.

Deferring Revenue for Memberships

Non-prorated memberships

For all non-prorated memberships (anniversary-based dues), the deferred start and end dates correspond to the membership term start and end dates, respectively.

Membership term start and end dates, and therefore the deferral start and end dates for deferred memberships, depend on the Membership updates date when... value selected for the member type on the Add Member Type or Add Association page.

The following values determine when the membership is officially active:

- First payment

- Percentage paid

- Invoice posted

If a batch contains a membership payment transaction for a member type that updates on first payment, when the batch is closed, a deferral record will be created.

If a batch contains a membership payment transaction for a member type that updates when a percentage of the membership is paid, if the payment meets the percentage criteria, when the batch is closed, a deferral record will be created.

If a batch contains a membership payment transaction for a member type that updates if the invoice is posted, if the batch has a membership invoice transaction, a deferral record will be created.

Pro-rated Memberships

For first year pro-rated memberships (calendar-based dues), the deferral start and end dates are the same as the term start and end dates. For example, if an organization offers a calendar-based membership that begins on January 01 and ends on December 31, when someone wants to join in March (which is the third period), the deferral start day will be January. When the March period is closed, revenue for January, February, and March will be recognized. The deferral end date will be December 31 (which is the membership expiration date).

For second year pro-rated memberships (calendar-based dues), the deferral start and end dates will be term start date and one year after the term start date. In the second year, the term will be the day after the first deferral ends through the term end date. For example, if an organization offers a calendar-based membership that begins on January 01 and ends on December 31, when someone wants to join in March (which is the third period), the deferral start day will be March. When the March period is closed, one period will be recognized. The deferral end date will be February 28th (or 29th). In the second year, the deferral term will run from March 1 through December 31.

Deferring Revenue for a Product

To set up deferred revenue for a product, on the specific Add Product page (Add Merchandise, Add Publication, etc), select the deferred check box and designate a deferred account for the revenue to go into once the revenue is recognized. You can also set up a recognize-after date.

The date in the recognize revenue date option in Events or the recognize after option in Merchandise determines when netFORUM recognizes the revenue from the sale. If the registration or product is sold before the specified recognition date, the revenue is not recognized, the money goes into deferred revenue. Any money in deferred revenue is recognized when the recognition process is run for the period that ends after the recognition date for the event or product. If the registration or product is sold after the recognition date, closing the batch sends the money directly to revenue for the period ending after the recognition date.

Note: When you close a batch, netFORUM creates ledger entries. When you close a period, netFORUM recognizes deferred revenue for the recognition dates contained in that period.

Closing an Accounting Period and the Revenue Recognition Process

A period can be closed only if all the previous periods have been closed and the closing date is after the end date of the period to be closed. For example, if the June period begins 06/01/2004 and ends on 06/30/2004, the earliest this period can be closed is July 1st 2004.

Before you try to close the period, you should check to see if there are any open batches in this period that have deferred transactions. Revenue can be recognized only if all deferred transactions are in closed batches

During the closing of the period, a batch in the same period has to be created, so that all of the "earnings" transactions can be associated and posted to the general ledger.

Cancellations

If an invoice for a deferred product is canceled, the cancellation will cancel the unused portion of the product e.g. if a membership is 5 months into its term, the system will default to canceling only 7/12 of the amount. This amount can be overridden at the time of the cancellation. The cancellation will first take the amount from deferred revenue. If more is canceled, the additional will be taken from the return account. If less is canceled, the difference will be recognized as revenue. If the canceled invoice has not been paid, any recognized amount that is not being canceled will remain as an open balance. The cancellation process includes the option of processing the remaining balance as a write off.

Note: Any transaction that is voided, adjusted, or has a line item amount equal to 0 will not be deferred, even if the product is marked as deferred.

Technical Information

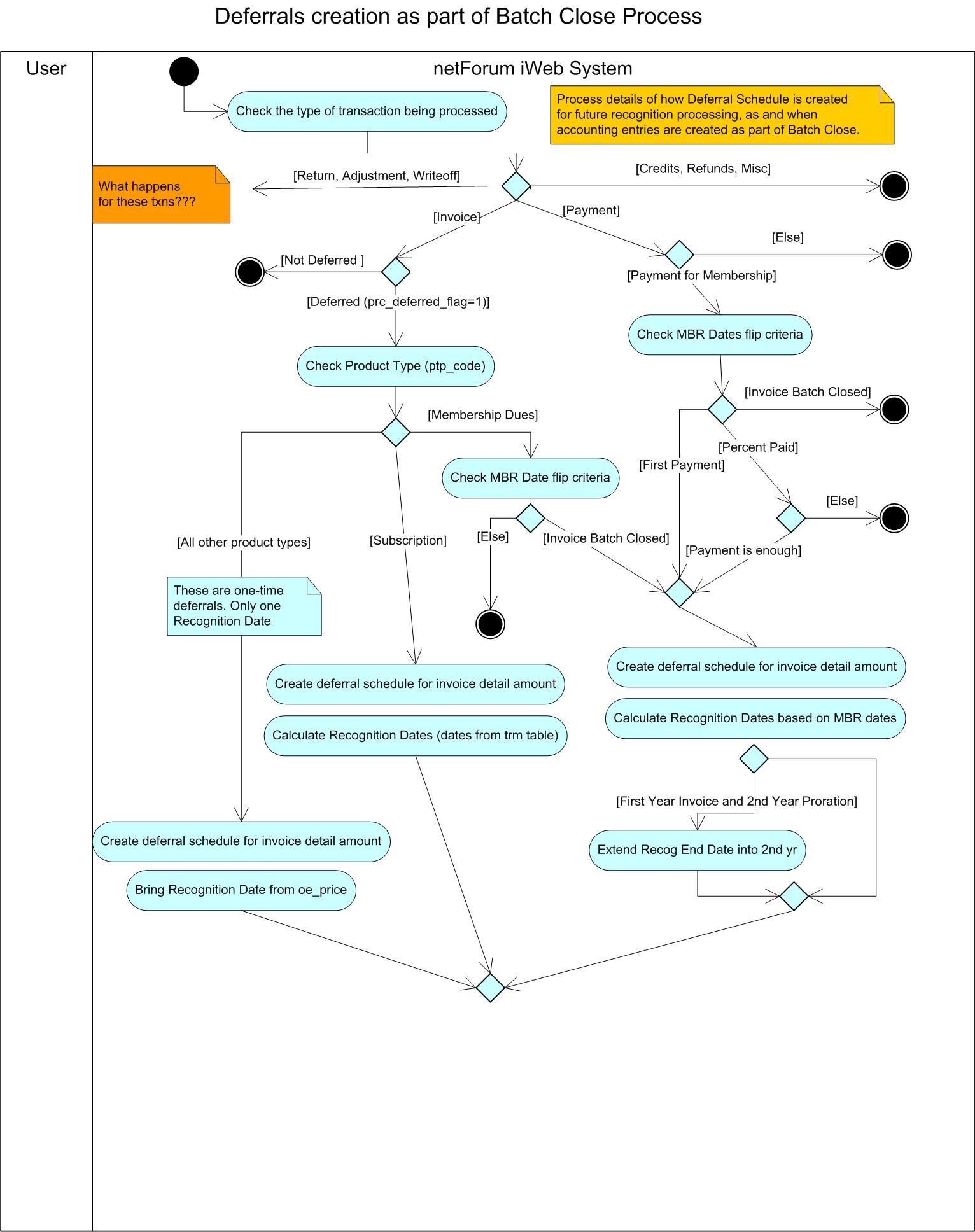

Deferral creation in Batch Close Process

|

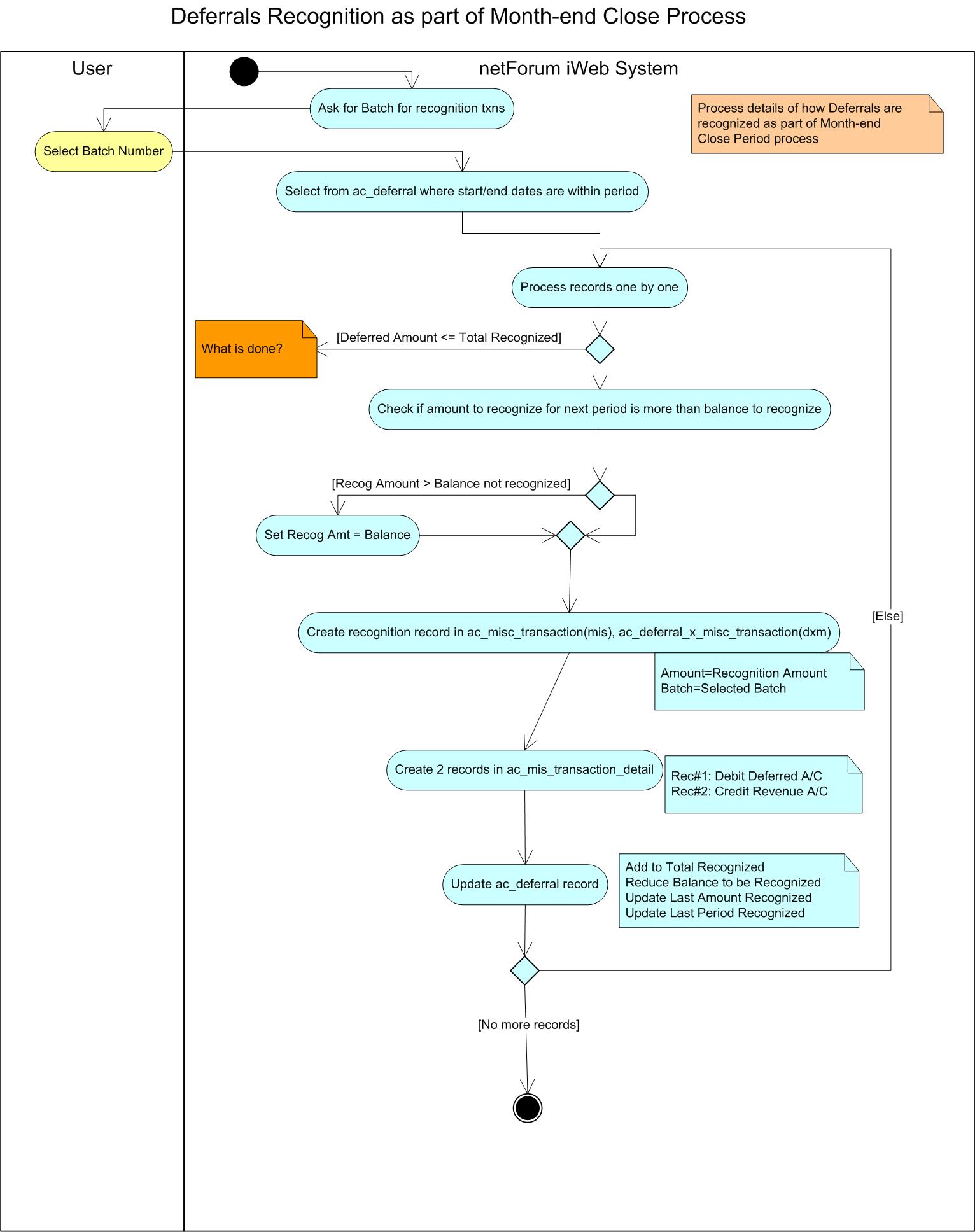

Deferrals Recognition in Month-end Close Process

|